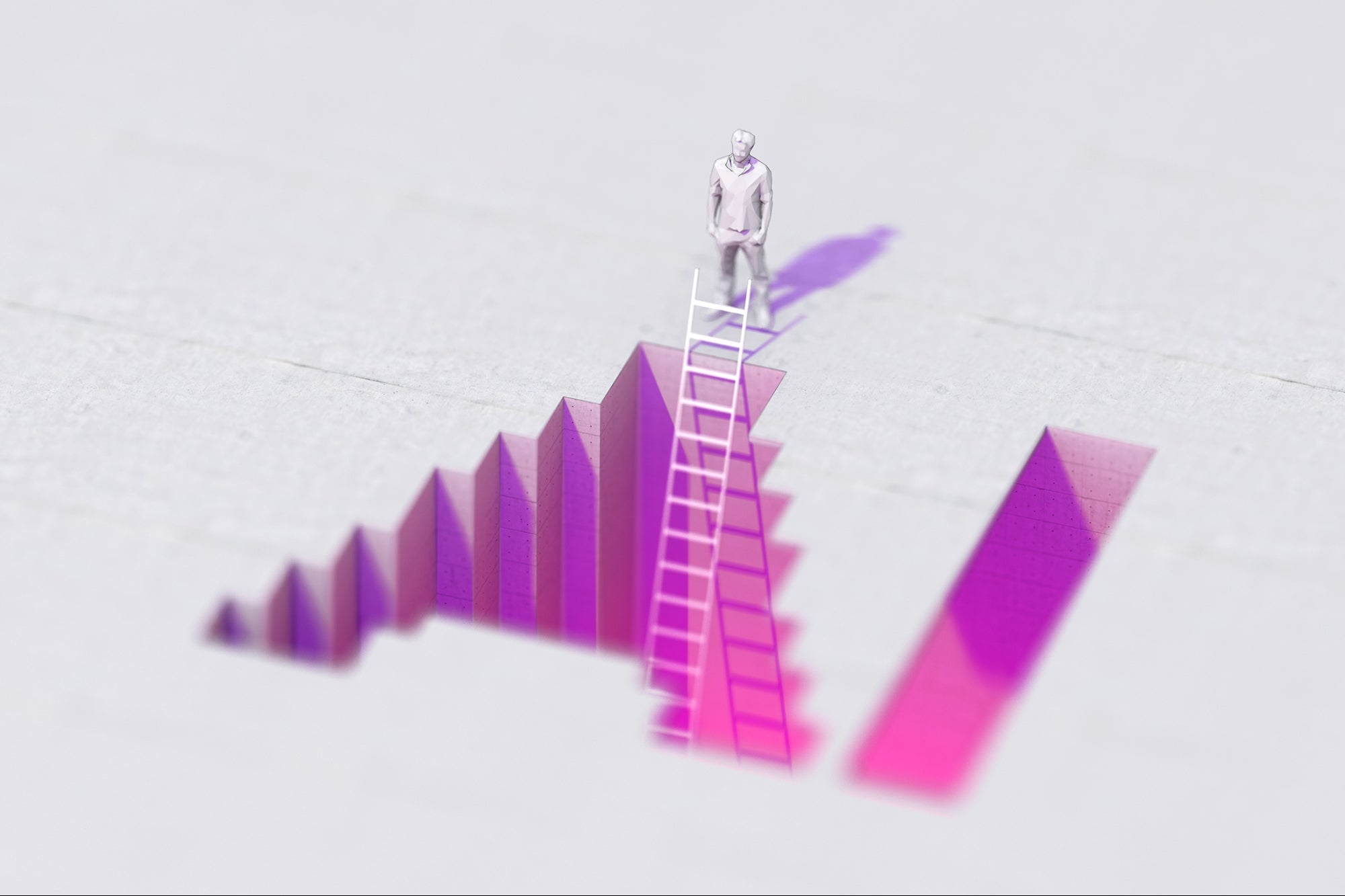

IPOs to Remain a Hopeful Avenue for Investors Post 7x Surge Sectors such as consumer/retail, fintech, and healthcare saw significant exit growth during the period. Meanwhile, strong public market exits helped balance the sharp decline in strategic sales, according to a Bain & Company-IVCA report.

Opinions expressed by BIZ Experiences contributors are their own.

You're reading BIZ Experiences India, an international franchise of BIZ Experiences Media.

The number of exits increased marginally by approximately 4 per cent to USD 6.8 billion in 2024, as several tech-focused companies recorded significant revenue growth and positive profitability trends, benefiting from improving macroeconomic conditions, said a joint report by Bain & Company and Indian Venture Capital Association (IVCA).

Sectors such as consumer/retail, fintech, and healthcare saw significant exit growth during the period. Meanwhile, strong public market exits helped balance the sharp decline in strategic sales, according to the report.

The report highlighted that public markets dominated exits in 2024, comprising three-fourths of the total exit value. Initial public offering (IPO) saw a strong comeback, growing 7x in exit value, driven by rising investor confidence due to increasing liquidity, recovery in valuations of key tech stocks, and supported by a favorable mix of regulatory reforms, macroeconomic improvements, and deferred IPOs from previous years.

In 2024, India's venture ecosystem exhibited a promising revival in IPO activity, with 10 VC backed listings, up from 4 in 2023 but still below the 2021 peaks, said Karan Mehta, Venture Principal, Green Frontier Capital.

"Notably, IPOs represented only 26 per cent of the total exit value, as strategic and secondary sales dominated the landscape, contributing over 84 per cent. This scenario highlights a significant opportunity for venture capitalists: while IPOs can generate impressive value creation, they often involve long timelines and elevated risks in volatile markets."

"To navigate this environment effectively, venture capital firms should prioritize enhancing their investment banking capabilities. Focusing on secondary transactions and strategic mergers and acquisitions can yield quicker, more dependable returns, which are vital for delivering distributions to limited partners (DPI). Adopting a pragmatic and opportunistic approach towards exits is essential. Relying on ideal market conditions for IPOs may hinder timely returns and increase portfolio risk. Instead, VCs should concentrate on facilitating liquidity events that resonate with current market dynamics, sector interests, and buyer motivations," said Mehta.

According to the report, the Indian IPO market outpaced global peers, with the US market remaining steady with 40 IPOs, similar to 202,3, and China seeing close to a 50 per cent decline vs. 2023. The report indicated that the market is likely to sustain momentum in 2025, with several notable IPOs in the pipeline like Zetwerk, Urban Company, Meesho, and CarDekho.

Increased liquidity, regulatory reforms, and deferred IPOs further supported the growing trend. Increased retail participation and robust mutual fund investments helped bolster liquidity, while initiatives like T+3 listings, a reduced lock-in period under the IGP program, and IPOs deferred from 2022–23 drove fresh IPO activity. Major tech stocks also recovered in India during the 2023-24 period, helping increase investor confidence in public markets.

Anil Joshi, Founder and Managing Partner, Unicorn Ventures, member-VC Council at IVCA, said that FY25–26 looks promising from an exit standpoint, especially through the IPO route.

"While current geopolitical conditions may create short-term headwinds, we believe this phase will be temporary and markets will stabilise soon after. We expect several companies to explore IPOs as a preferred exit strategy—at Unicorn, we foresee a couple of IPOs from our Fund II portfolio over the next few years. Overall, the outlook for both PE/VC investments and IPO activity remains strong," said Joshi.

Notable consumer tech exits maintained momentum, led by key notable exits like Zomato's USD 910 million public trade, including Swiggy, Firstcry, and Lenskart's USD 200 million secondary exit.

Pearl Agarwal, Founder and Managing Partner, Eximius Ventures, said that IPOs continue to remain a very strong avenue to exit for both VCs as well as founders, with the markets being a bit more volatile since September of last year.

"As a private markets investor or as a VC fund, we remain quite excited about this avenue to generate more liquidity for our investors, our founders, and overall the ecosystem, and are increasingly gearing up our companies to head in that direction. Which also means that if a company wants to go public in the next two to three years, they should start to strengthen their reporting, their corporate governance, their thought process, their strategic path, and vision from today itself," said Agarwal.