5 Reasons Why Your First Company Will Probably Fail — Unless You Make These Changes Scaling a startup is hard — only 0.061% of companies grow to over $50 million. This article will teach you what you need to know to be one of those successful scaling companies.

By George Deeb Edited by Micah Zimmerman

Opinions expressed by BIZ Experiences contributors are their own.

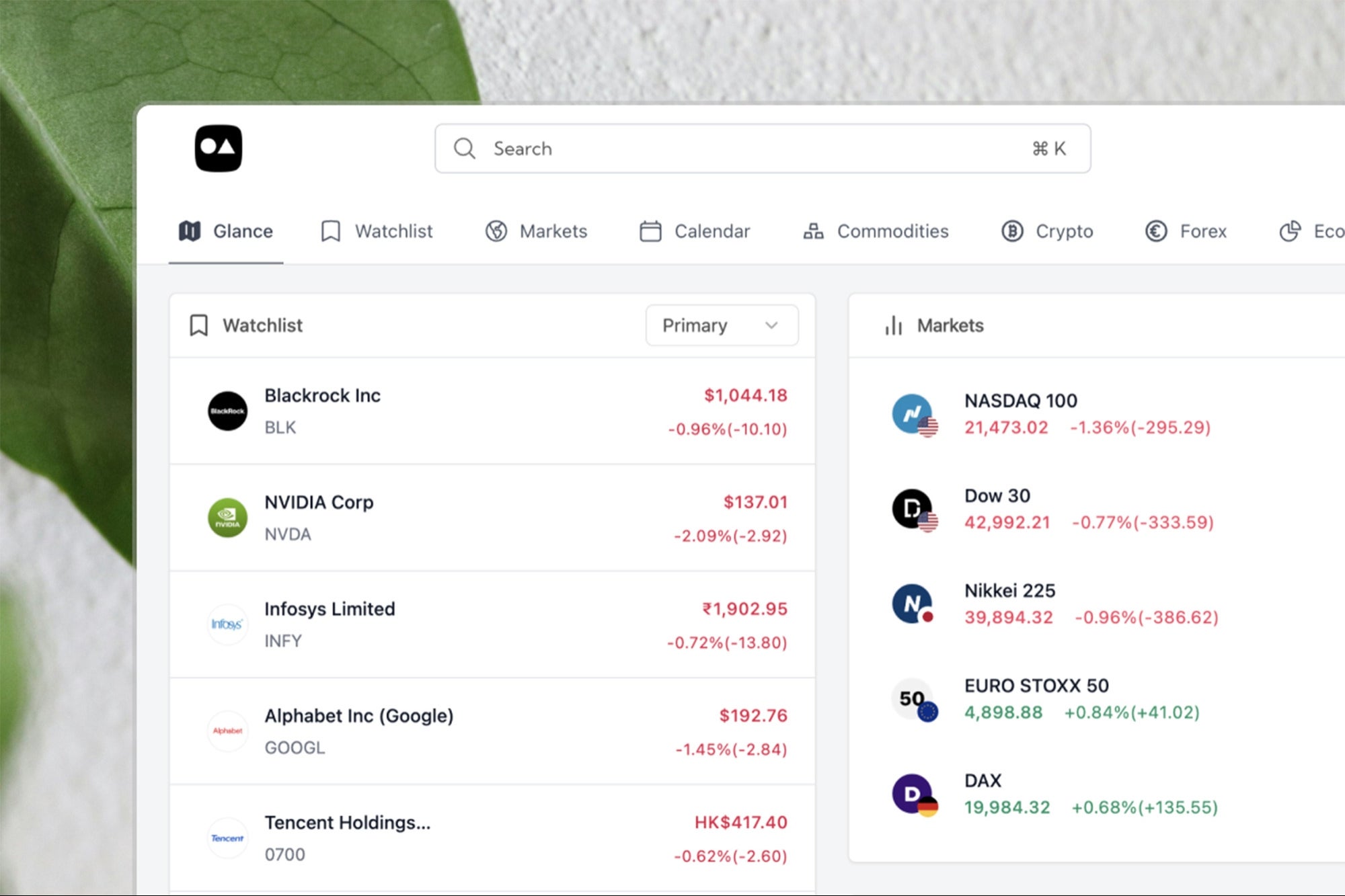

My colleague and serial BIZ Experiences, Scot Wingo, recently posted on LinkedIn about how hard it was to scale a business. He referenced data from a book by Verne Harnish. The core of the story was this chart:

- There are 28,000,000 businesses in the U.S.

- 96% of them are under $1MM in revenue (first "valley of death," getting to first $1MM)

- 4% are $1MM-$10MM in revenue (second "valley of death," breaking through $10MM)

- 0.4% are $10MM-$50MM in revenue (third "valley of death," breaking through $50MM)

- Only 0.061% are over $50MM in revenue

I was so taken aback by the data here that I thought it was worthy of a deeper discussion. So, why is it so hard to scale?

Few best-educated BIZ Experiencess

U.S. News & World Report only lists 39 universities as having the best undergraduate BIZ Experiencesship programs. Let's estimate that the average class size at those business schools is 1,000 per school and that 10% of students major in BIZ Experiencesship (or 100 per school). So, there are 3,900 highly regarded BIZ Experiencesship graduates per year.

With an average career length of 44 years (from 21 to 65 years old), that means there is a pool of 171,600 people best trained in BIZ Experiencesship. There are 333.3 million people in the United States, and 28.94% of them are "working age," creating a pool of 96.5 million workers. That means only 0.18% of workers properly knew what they were signing up for in the world of BIZ Experiencesship before diving in headfirst. Now, all of a sudden, the numbers in the chart don't look that far off from what should have been reasonably expected.

Worth mentioning, notice I focused on BIZ Experiencesship majors. I intentionally ignored business majors. Most business degrees pump out graduates who work in large companies. The skillsets needed for running a Fortune 1000-sized company are materially different than the skillsets needed for taking a piece of paper idea and turning it into a successful business.

Related: 5 Strategies to Know As You Scale Your Business

You don't do your homework before launching

Many businesses that launch do so without building a proper business plan, including doing homework on their industry and competition, identifying affordable sales and marketing opportunities, and ensuring a good product market fit.

Would you take a test in school without first doing your homework or studying for the exam? Of course, you wouldn't. So don't do it when launching a business, especially given the large amount of dollars you will be putting at risk, potentially getting flushed down the toilet with the low odds of success discussed in this article.

You don't have the right skills

You have to be honest with yourself. Are you the right person to launch this business and execute the business plan? Do you have the skillsets required for strategy, management and fundraising? You most likely don't.

So that means you need to hire the people with the right skills or surround yourself with mentors and advisors who have "been there and done that" before to help get you up the learning curve. Given the capital requirements, there is very little room for making mistakes in the world of startups.

Related: Want to Scale Up Without Selling Out? Do This First

You don't evolve

The chart above illustrates four "valleys of death." These are the points where most businesses "stall out" in their growth curves. Why is that? Returning to the last paragraph, they lack the skills needed for the next phase of the company's growth.

The skills needed to grow from $1MM to $10MM in revenues are completely different from the skills needed to grow from $10MM to $50MM. The bigger you get, the more complexities there are. Bigger companies have to start thinking about things like international expansion and mergers and acquisitions, which were never considered for smaller businesses.

So, as you scale, you need to re-assess your senior management needs to ensure that the new team has also "been there and done that" for the skillsets needed for the next phase of your growth. They are materially different.

They run out of money

Some startups run out of money due to events outside their control, like a crash in the economy or the financial markets. Other startups run out of money simply because they are under budgeted for their entire needs or were too aggressive with their revenue growth assumptions.

Often, by the time they realize they are out of cash, it is too late to raise new capital, as the fundraising process can take up to six months. So plan ahead and keep your eyes firmly glued to your "gas tank."

When the going gets tough, the weak throw in the towel

Startups are full of disappointments and letdowns. You may need to listen to 100 people say "no" before you find that one person who is willing to say "yes." Not everyone has the "fire in the belly" needed to break down those walls and push the company on to future success in the face of all these headwinds. So, if you don't like the idea of feeling like you are constantly "pushing water uphill," you probably shouldn't consider a career in BIZ Experiencesship. It is not a career for the weak of the heart.

Why do venture investors take this level of risk?

With this low level of success in scaling businesses, why do venture capitalists even invest at this stage?

First of all, professional venture capitalists are exactly that . . . professionals! They have done this for a living for decades and have listened to thousands of BIZ Experiencess pitch their businesses and know what it takes to succeed. So, for many of them, they are confident in their own experiences from their past portfolio companies to "defy the odds".

Secondly, they employ a portfolio strategy: out of any one fund, they make 25-30 investments. They know 90% of them will break even or lose money. But they also know the 2-3 breakthrough will generate a large enough return to generate an impressive return for the entire fund. For example, if they make a 20x return on 10% of the portfolio and break even on the rest, the fund still yields a 25-30% annual return to their investors over a five-year period. Point here: diversification is key; don't put all your eggs in one basket.

Lastly, the best venture capitalists know how to game the system. Let's say they are investing in marketing software companies. The good ones have relationships with CMOs at many companies, that can help them do due diligence on the merits of the startup's idea and become initial customers for that startup (which is the hardest part of scaling—finding customers). What will be your "unfair advantage"?

Related: If You Want Your Business to Last, Slow Down — 3 Ways To Prepare Your Company For The Long Haul

Should you, as an BIZ Experiences, take on this level of risk?

After reading this article, do you think you have what it takes to be one of the 0.061% that can break through to over $50MM in revenue, which is what investors will be listening for?

- Do you have a good, well-researched idea?

- Do you have the right team in place?

- Do you have the capital lined up to succeed, in both good times and bad, with enough cushion in place for the unexpected hiccups, which will be many?

- Are you prepared to hand over the CEO reins for the next chapter of your growth?

- Do you have the intestinal fortitude to plow through all the roadblocks?

- Do you have an "unfair advantage" that will help you with customer acquisition?

If so, maybe we will be singing your praises in the years to come. But, there are very high odds, based on the data above, that we will not. So, be honest with yourself before rolling the dice and putting your life savings at risk. Especially since you won't have the luxury of a portfolio strategy, like a venture capitalist has, with all your eggs in one basket. Batten down the hatches, it should be wild ride. Prepare for the worst, and hope for the best.