Roofstock Is Making Investing in Property Possible for Millennials Millennials are well behind preceding generations in home ownership.

By StackCommerce Edited by Jason Fell

Disclosure: Our goal is to feature products and services that we think you'll find interesting and useful. If you purchase them, BIZ Experiences may get a small share of the revenue from the sale from our commerce partners.

Although millennials represent the largest generation in the United States, they are significantly behind their parents and grandparents in homeownership. An Urban Institute study indicates that the homeownership rate among millennials aged 25 to 34 is about 8% lower than it was for Gen Xers and baby boomers when they were the same age. This is just one of the many ways millennials have been left behind by American economic progress in the 21st century.

Millennials, by and large, live in cities. However, even the highest earners in the generation are handcuffed by enormous rent payments and an elevated cost of living that makes buying a home or investing in property in the areas they live nearly impossible. How can you afford a mortgage payment when you've been spending $2,000 a month on rent for the past five years?

What was once exceedingly difficult, however, is much easier with Roofstock.

Roofstock is a leading online marketplace enabling people to invest in property outside of their cities and collect rent, all through the platform. Their marketplace has hundreds of homes available, many of which are less than $100,000, and many of which yield more than $10,000 a year in rent.

Unlike the traditionally exclusive and inaccessible real estate market, Roofstock emphasizes inclusivity, opening their doors to first-time, seasonal, or simply mildly curious investors. Their low-cost entry model has meant that 75 percent of Roofstock users are first-time real estate investors, and more than half are under the age of 35.

Because millennials are often saddled with student debt, it's especially difficult to invest in property like their parents or grandparents may have done. Roofstock turns the traditional model on its head by offering single-family rentals (SFRs); homes that investors don't buy to live in, but rather invest in to generate rent and earn income passively. It's a clever way to increase cash flow and help reduce the burden of fixed costs like your own rent and loan payments.

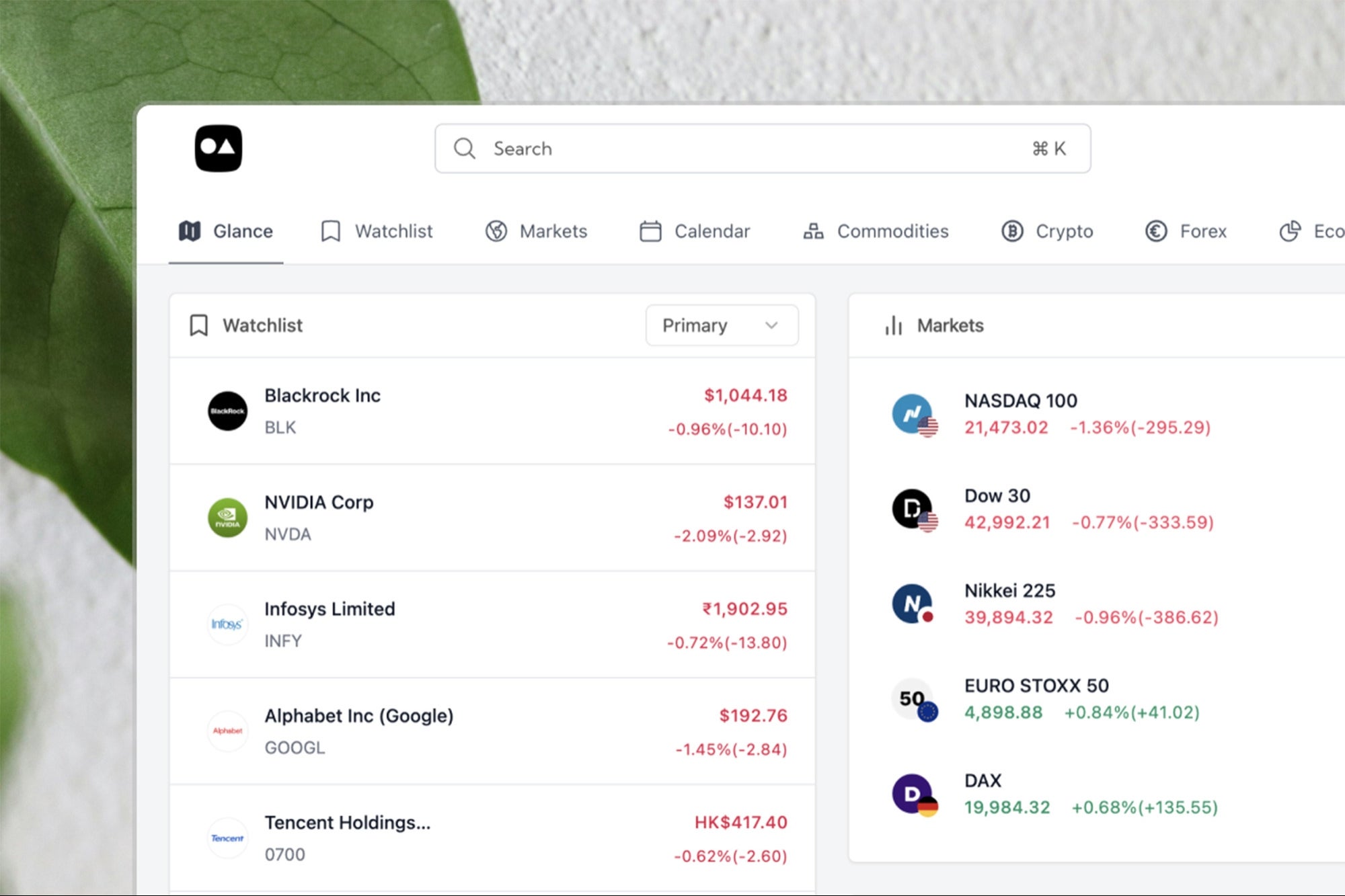

Roofstock also removes many of the hassles of home buying and land ownership. They use PropTech to make the transition of buying and selling as seamless as possible for both investors and tenants. They'll do the inspection and make it available online before listing a property, provide lending options to help you invest, and put you in touch with financing partners to make investing a breeze. They'll even leave the day-to-day operations of managing the rental to a professional property manager. Not only will these investments increase cash flow, but properties may appreciate over time, increasing the rate of return.

Roofstock aims to make real estate investing as easy as buying a new T-shirt. The evolution of investment tech has reduced the intimidating tasks of house hunting and scouring neighborhoods to a mere numbers-crunching game. Their data-backed investing process helps investors identify the best properties for their investment by surfacing data like neighborhood ratings, school system quality, higher yield potential, and more. Plus, they offer detailed property photographs, valuation, and comparisons with similar homes in 70 US markets, including Atlanta, Memphis, Indianapolis, Jacksonville, and the greater Chicago area.

Roofstock's high standards for the properties they accept to the site ensure that investors are making fiscally sound decisions for their long-term future. Affording urban life is difficult, which is why Roofstock makes it easier for young customers in coastal cities to invest in areas that offer better cash flow.

Investing in SFRs carries less risk and offers a low-capital entry point that offers consistent cash flow and low volatility. It's the perfect kind of investment for millennials with a little disposable income who want to get involved in real estate investment.

Check out Roofstock's listings today and discover a new opportunity for yourself. If you buy a property, Roofstock will give you a $250 VISA gift card to say thanks.