Tripadvisor Stock Gap and Crap. Here's Why. The world's largest travel guidance platform, Trip Advisor, Inc. (NASDAQ: TRIP), experienced strong travel demand in its Q4 2022 earnings release. It

By Jea Yu

This story originally appeared on MarketBeat

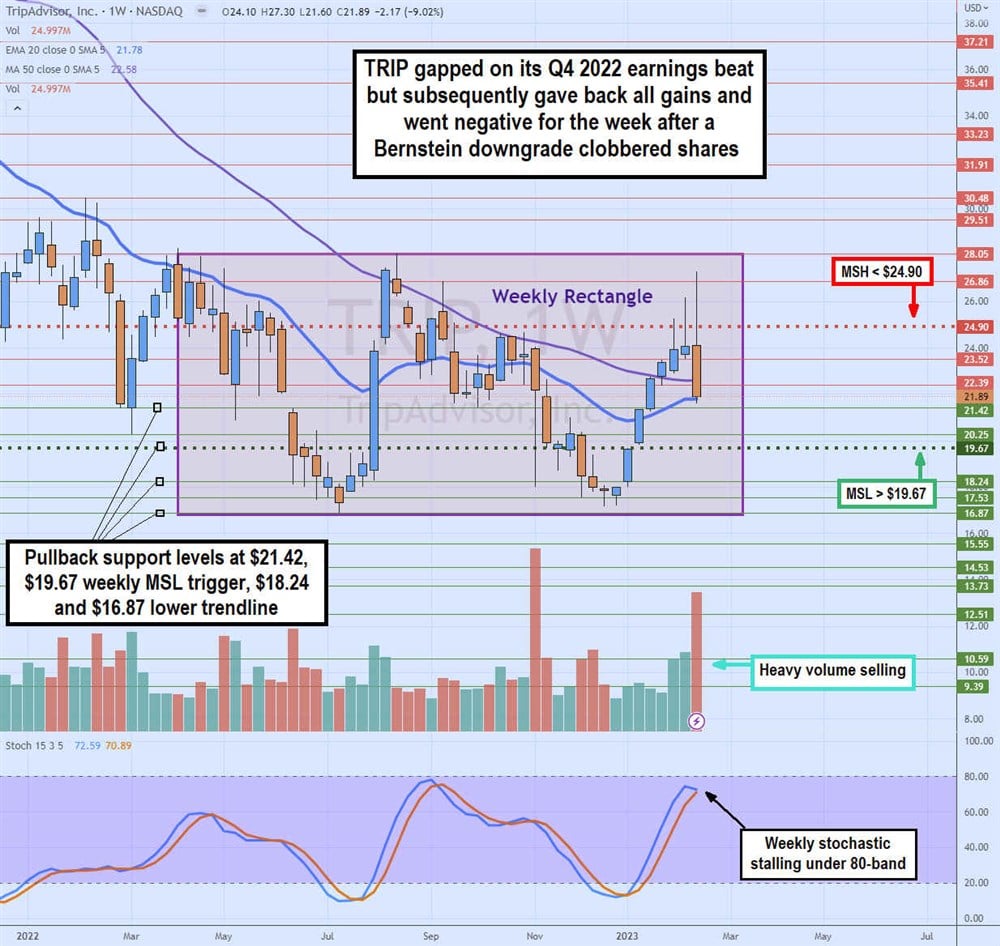

The world's largest travel guidance platform, Tripadvisor, Inc. (NASDAQ: TRIP), experienced strong travel demand in its Q4 2022 earnings release. It caused shares to gap 8% the following morning hitting a high of $27.30 before giving back all its gains and further selling off nearly 15% from its post-earnings highs.

This rug-pulling price action is described as a gap and crap. It leaves investors wondering what just happened. In the case of Trip Advisor, the selling stems from a Bernstein downgrade based on the Company's new investment plans.

Strong Travel Demand

The post-pandemic rebound in the travel and leisure segment has been expressed by airlines to booking platforms. While the sector was an industry's epicenter during the pandemic, it's one of the most robust recovery segments post-pandemic. The pent-up demand accelerated the rebound in business to overshoot its pre-pandemic 2019 metrics.

This sentiment has been echoed throughout earnings season from airlines like American Airlines Group Inc. (NYSE: AAL), Delta Air Lines Inc. (NASDAQ: DAL), and United Airlines Holdings, Inc. (NYSE: UAL). Online platforms like Airbnb Inc. (NASDAQ: ABNB) and Booking Holdings Inc. (NASDAQ: BKNG) continue reinforcing this trend. Even cruise stocks like Carnival Cruise Corporation & plc (NYSE: CCL) and Royal Caribbean Group (NYSE: RCL) see a rebound thanks to strong consumer demand for services and experiences.

Robust Recovery

On Feb. 14, 2022, Tripadvisor released its fourth-quarter 2022 results for December 2022. The Company reported an earnings-per-share (EPS) profit of $0.16 versus consensus analyst estimates of $0.02, beating estimates by $0.12. Adjusted EBITDA grew to $43 million versus the $36 million consensus.

Revenues climbed 47% YoY to $354 million, beating consensus analyst estimates for $344.24 million. Margins recovered throughout 2022. Mixed recovery and margin pressure still exist in parts of its portfolio, particularly in its Tripadvisor Core segment.

Growth By Segment

Growth was driven by its Viator platform, which offers tours and activities for travelers worldwide. In 2020, its gross bookings were $2.7 billion. Nearly 70% of the large but highly fragmented and underpenetrated experiences market still operates offline. It's expected to grow to over $275 billion by 2025. Its tour partners are "receiving more value than ever before ."To accelerate its leadership position, the Company will invest in the growth of this segment in 2023.

The Company will focus on improving margins and growing its restaurant and diner base in 2023. Its online dining platform TheFork connects millions of diners with its restaurant partners. Repeat customers' direct bookings were responsible for more than 75% of total bookings in 2022.

Its Tripadvisor Core segment grew revenues 45% YoY to $966 million and reached nearly 79% of 2019 levels. It's been the core of the business for over 20 years. The Company will push for deeper engagement with travelers and provide essential trip-planning tools. It includes pre-trip and in-destination on a mobile-first approach.

Updated Strategy

Tripadvisor CEO Matt Goldberg commented on its strategy, "We've introduced an updated operating model that balances the autonomy and empowerment of P&L ownership with strong functional alignment and collaboration." He continued, "We've added critical new leadership roles and aligned our teams around product, marketing, technology and data, sales and operations. This breaks down silos, and already, we're seeing improved efficiency and productivity and increased capacity in areas like engineering to reallocate resources to our top strategic priorities."

Bernstein Downgrade

Bernstein analyst Richard Clarke complemented its sensible strategic plan but stressed that near-term impacts would reduce EBITDA estimates for the next two years. He commented, "This is going to be a steady multi-year roll-out, and the result seems more defensive than offensive with the aim of long-term steady profitable growth', which is broadly in-line with the consensus view and below our previous expectations." He downgraded shares from Outperform to Market Perform and cut the price target to $26 from $28 per share.

Weekly Rectangle

TRIP shares have been in a weekly triangle since April 2022, when shares fell from $28.05 to a low of $16.87 by July 2022. Shares bounced on a weekly market structure low (MSL) breakout through the $19.67 trigger to test the $28.05 upper trendline, only to fail and form a market structure high (MSH) sell trigger under $24.90.

TRIP shares broke down again, falling to shy of the lower trendline of the rectangle before bouncing through the weekly MSL trigger again at $19.67 in January 2023. The stock continued to surge higher, driving it to hit a high of $27.30 on its Q4 2022 earnings gap before plunging back down to the weekly 20-period exponential moving average (EMA) support at $21.78. Pullback support levels are $21.42, $19.67 weekly MSL trigger, $18.24, and $16.87 lower rectangle trendline.

Tripadvisor is a part of the BIZ Experiences Index, which tracks some of the largest publicly traded companies founded and run by BIZ Experiencess.