Is It Finally Time to Buy Zoom Stock? Zoom has shown little signs of life amid the broader market tumble. Yet, with it trading around where it was near the start of the pandemic, some investors might want...

This story originally appeared on Zacks

Zoom Video ZM was the superstar of the early days of the pandemic. ZM shares went on a massive run on the back of insane growth as paying business customers flocked to the subscription video conference service.

Zoom stock has tumbled since October 2020 after its share price and valuation ballooned. Wall Street finally took a breath and realized ZM could never hope to maintain its covid-boosted growth.

The video conferencing company is still crucial to many businesses and will likely maintain its relevance in what seems sure to be a more remote/hybrid heavy working world.

Zoom stock has shown little signs of life amid the broader market tumble. Yet, with it trading around where it was near the start of the pandemic, some investors might want to consider Zoom ahead of its Q4 fiscal 2022 financial release on Monday, February 28.

The Short Story

Zoom went public in April of 2019 and it found success long before the pandemic in the digitalized business landscape. Its appeal to paying business clients, both big and small, to help them stay constantly connected, cut down on travel, and more helped sales soar 88% in its first year public.

The pandemic then forced countless businesses and other entities to pay for Zoom's video conference solutions. Despite the slow return to normal, many firms and people simply won't be returning to the office full-time anytime soon, and perhaps never again.

Zoom is prepared to succeed in the hybrid, work-from-anywhere world and it's beefed up its offerings to include digital contact centers, phone services, and more as part of the larger cloud-based updating of office communication. The goal is to have a unified, digital space for calls, video, meetings, chat, and more.

Image Source: Zacks Investment Research

Some Other Fundamentals

Zoom revenue skyrocketed 325% from $623 million to $2.7 billion in FY21. Most recently, it closed the third quarter of FY22 with over 512K customers with more than 10 employees. Meanwhile, its customers bringing in over $100K in trailing 12 months revenue surged 94% YoY to over 2,500.

Looking ahead, Zacks estimates call for ZM's FY22 revenue to surge another 54% from $2.7 billion to $4.1 billion, with FY23 set to climb 17% higher to $4.8 billion (up from $331 million in 2019). ZM's adjusted FY22 earnings are projected to soar 45% to $4.85 a share, after they skyrocketed 850% last year.

Current Zacks estimates call for its FY23 earnings to slip about 10% vs. these tough-to-compete against years. That said, Zoom has topped our quarterly earnings estimate in every period since its market debut and its overall EPS outlook has soared in the last year-plus, even though it's faced setbacks.

Investors might also be pleased, at this point, that Zoom's planned acquisition of digital call center firm Five9 was scrapped in the fall. Organic growth in the area could prove far more beneficial in the long run. And Zoom boasts the balance sheet to pursue different and even more futuristic areas, with $5.4 billion in cash and equivalents and $7 billion in total assets vs. $1.9 billion in liabilities.

Image Source: Zacks Investment Research

Bottom Line

Zoom stock has tumbled 80% from its Oct. 2020 highs to $120 a share. The stock is trading roughly where it was in late March and early April of 2020, having lost nearly all of its covid gains. The return to these levels, coupled with its growth outlook has helped ZM's valuation turn more reasonable.

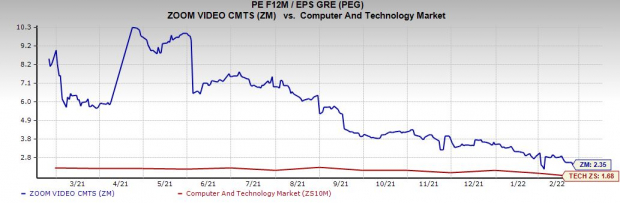

Zoom's forward PEG ratio (P/E ratio divided by its growth rate) sits at 2.4. This is down from 10.3 in 2021 and is far closer to its peer group's 1.2 and the larger Tech Sector's 1.7. Meanwhile, Zoom is starting to offer some value compared to fellow business software firm Salesforce and its PEG ratio of 5.2 and Veeva Systems' 4.9—for reference, Microsoft's forward PEG ratio is 2.2.

Zoom stock has been through a wild two years and many investors might simply stay away from the stock altogether. But it certainly looks far more appealing after nearly all of its pandemic gains were wiped out, even though many of the paying customers Zoom gained aren't going anywhere, at least not anytime soon.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It's a little-known chemical company that's up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks' Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zoom Video Communications, Inc. (ZM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research