Innovative Industrial (IIPR) Expands With Massachusetts Asset Innovative Industrial's (IIPR) Massachusetts property buyout and tie-up with a subsidiary of Curaleaf Holdings are expected to help this REIT enjoy solid opportunities in the company's markets.

This story originally appeared on Zacks

Innovative Industrial Properties IIPR recently announced that it has closed the acquisition of a Massachusetts property for $21.5 million. The company acquired the property to enhance its portfolio and bank on healthy market fundamentals.

This real estate investment trust ("REIT"), focused on a cannabis-centered real estate portfolio, has also entered into a long-term, triple-net lease agreement for the property with a subsidiary of Curaleaf Holdings, Inc.

The property, comprising roughly 104,000 square feet of industrial space in Webster, is fully built out and operational as a regulated cannabis cultivation and processing facility. It includes cultivation, manufacturing, office, administrative and storage space and is estimated to produce around 32,000 pounds of cannabis flower annually.

The expansion of the long-term real estate partnership with Curaleaf is a strategic fit. Particularly, Curaleaf, headquartered in Wakefield, MA, is a top-regulated cannabis operator in the United States. It has a presence in 22 states and has emerged as the largest vertically integrated cannabis company in Europe. In terms of capital investment, Curaleaf is IIPR's fifth-largest tenant partner.

The legalization of marijuana for medical use across several U.S states and recreational use in several states has opened opportunities for the cannabis industry. Therefore, Innovative Industrial Properties has incentives to partner with experienced medical-use cannabis operators and serve as a vital source of capital by acquiring and leasing back their real estate assets. Its strategy is to acquire existing, redeveloped and under-development industrial buildings, including enclosed greenhouse facilities.

Innovative Industrial's expansion efforts have boosted the company's footprint to 111 properties with 8.7 million rentable square feet (including approximately 2.1 million rentable square feet under development / redevelopment). These properties are located in Arizona, California, Colorado, Florida, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nevada, New Jersey, New York, North Dakota, Ohio, Pennsylvania, Texas, Virginia and Washington.

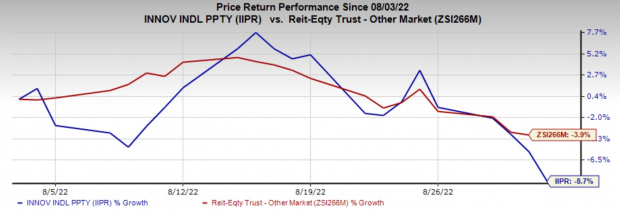

Over the past month, shares of this Zacks Rank #3 (Hold) company have declined 8.7%, wider than the 3.9% fall of the industry. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Stocks to Consider

Some key picks from the REIT sector include Extra Space Storage EXR and Host Hotels & Resorts HST.

The Zacks Consensus Estimate for Extra Space Storage's ongoing year's funds from operations (FFO) per share has been raised 2.3% over the past month to $8.46. EXR sports a Zacks Rank #1.

The Zacks Consensus Estimate for Host Hotels & Resorts' 2022 FFO per share has moved 4.8% upward in the past week to $1.75. HST presently carries a Zacks Rank of 2 (Buy).

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It's a little-known chemical company that's up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks' Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST): Free Stock Analysis Report

Extra Space Storage Inc (EXR): Free Stock Analysis Report

Innovative Industrial Properties, Inc. (IIPR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research