Innovative Industrial (IIPR) Cheers Investors With Dividend Hike Innovative Industrial's (IIPR) 2.9% sequential dividend hike reflects its business strength and focus on increasing shareholders' wealth.

This story originally appeared on Zacks

Delighting its shareholders, Innovative Industrial Properties IIPR announced a 2.9% hike in its third-quarter dividend to $1.80 per share from $1.75, paid in the prior quarter. The new dividend will be paid on Oct 14, to shareholders of record on Sep 30, 2022.

Solid dividend payouts are the biggest enticement for REIT shareholders, and IIPR, which is focused on a cannabis-centered real estate portfolio, is also committed to the same. In fact, with this latest hike, the company's common stock dividends declared for the 12 months ending Sep 30, 2022, reached $6.80 per share, reflecting an increase of 25% over dividends declared for the 12 months ended Sep 30, 2021.

Excluding the latest hike, Innovative Industrial has increased its dividend 14 times in the last five years and the five-year annualized dividend growth rate is 65.98%.

Moreover, based on the hiked rate, the annualized dividend comes to $7.20 per share. At this new rate, the annualized yield comes in at nearly 8%, based on the stock's closing price of $90.13 on Sep 15. This is ahead of the industry's dividend yield of 3.92%.

The company has a solid business model to support its profitability over the long term and reward shareholders simultaneously. Moreover, the legalization of marijuana in the United States for medical and recreational use has opened opportunities for the cannabis industry and IIPR in particular to prosper.

To capitalize on growth opportunities, IIPR is focusing on the acquisition of existing, redeveloped and under-development industrial buildings, including enclosed greenhouse facilities. IIPR partners with experienced medical-use cannabis operators and serve as a vital source of capital by acquiring and leasing back their real estate assets. IIPR recently announced the purchase of a property in Massachusetts for $21.5 million.

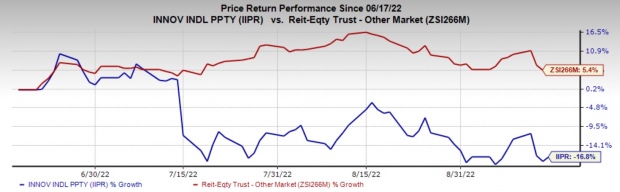

Currently, Innovative Industrial Properties carries a Zacks Rank #3 (Hold). Over the past three months, shares of the company have declined 16.8% against the industry's rally of 5.4%. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Stocks to Consider

Some key picks from the REIT sector include Prologis PLD and Extra Space Storage Inc. EXR.

Prologis carries a Zacks Rank of 2 (Buy) at present. Prologis' long-term growth rate is projected at 9.0%. The Zacks Consensus Estimate for PLD's 2022 funds from operations (FFO) per share has been revised marginally upward in the past two months.

The Zacks Consensus Estimate for Extra Space Storage's 2022 FFO per share has moved 1.6% upward in the past month to $8.46. Extra Space Storage's long-term growth rate is projected at 8.7%. EXR presently carries a Zacks Rank of 2.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It's a little-known chemical company that's up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks' Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD): Free Stock Analysis Report

Extra Space Storage Inc (EXR): Free Stock Analysis Report

Innovative Industrial Properties, Inc. (IIPR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research