Global Investing: A Closer Look at the Russian Debacle Global Investing: A Closer Look at the Russian Debacle

By Bryan Hayes

This story originally appeared on Zacks

The geopolitical event that is taking place in Russia serves as a stark reminder of the risks we must account for in the investing world. One of the risks of international investing is what is known as country risk, or the risk arising from uncertainty associated with investing in a particular country.

This is a more general term and can include various components such as economic and political instability, limited liquidity, and other events that adversely impact a country's business and trade environment.

Substantial volatility involving severe fluctuations in exchange rates is also a grave concern. The Russian Ruble, for example, is crashing to new all-time lows and has lost over 70% of its value versus the U.S. dollar since its peak in 2008.

The recent international response to the Russia-Ukraine conflict in terms of sanctions and banking restrictions has been fast and furious and is contributing to a run on the Russian stock market. The Russia Equity ETF RSX has tumbled over 60% from its peak this past November and is currently down nearly 25% just today:

Image Source: Stockcharts.com

Investors that hold a diversified portfolio with an international equity allocation may have some exposure to RSX or a similar Russian ETF. As we zoom out, we find that there really hasn't been much benefit to owning Russian equities over the past 15 years, whereas U.S. investors have been rewarded:

Image Source: Stockcharts.com

Russia has been considered a foreign developed nation, but the country is somewhat in transition. Poverty is widespread and the standard of living is relatively low. As is characteristic of a non-developed nation, the exportation of natural resources fuels much of Russia's economy.

Typically, investors with an international allocation have exposure to both foreign developed and foreign emerging markets. Both foreign developed and emerging markets have vastly underperformed the U.S. over the last decade:

Image Source: Stockcharts.com

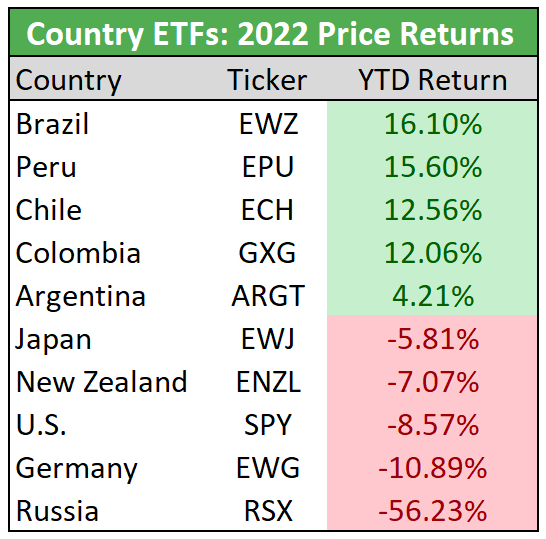

However, country returns year-to-date suggest the tide may be turning:

Image Source: Zacks Investment Research

It's far too early to tell if these bullish trends will continue. Emerging market ETFs have experienced short periods of outperformance over the past decade, only to continue the overall underperformance trend as a whole. Generally speaking, valuations for most emerging markets are relatively attractive. We can see above that Brazil has led the way this year, while the Russia Equity ETF (RSX) has plummeted.

Investing both domestically and internationally carries risks and it's vital that investors understand the inherent hazards before taking positions. Risk management is paramount in today's climate to reduce the probability of undesirable outcomes. The situation with Russia serves as yet another example that investors need to keep a close eye on global events and their implications from an investment standpoint.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year's 2021 Zacks Top 10 Stocks portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don't miss your chance to get in on these long-term buys

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VanEck Russia ETF (RSX): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research