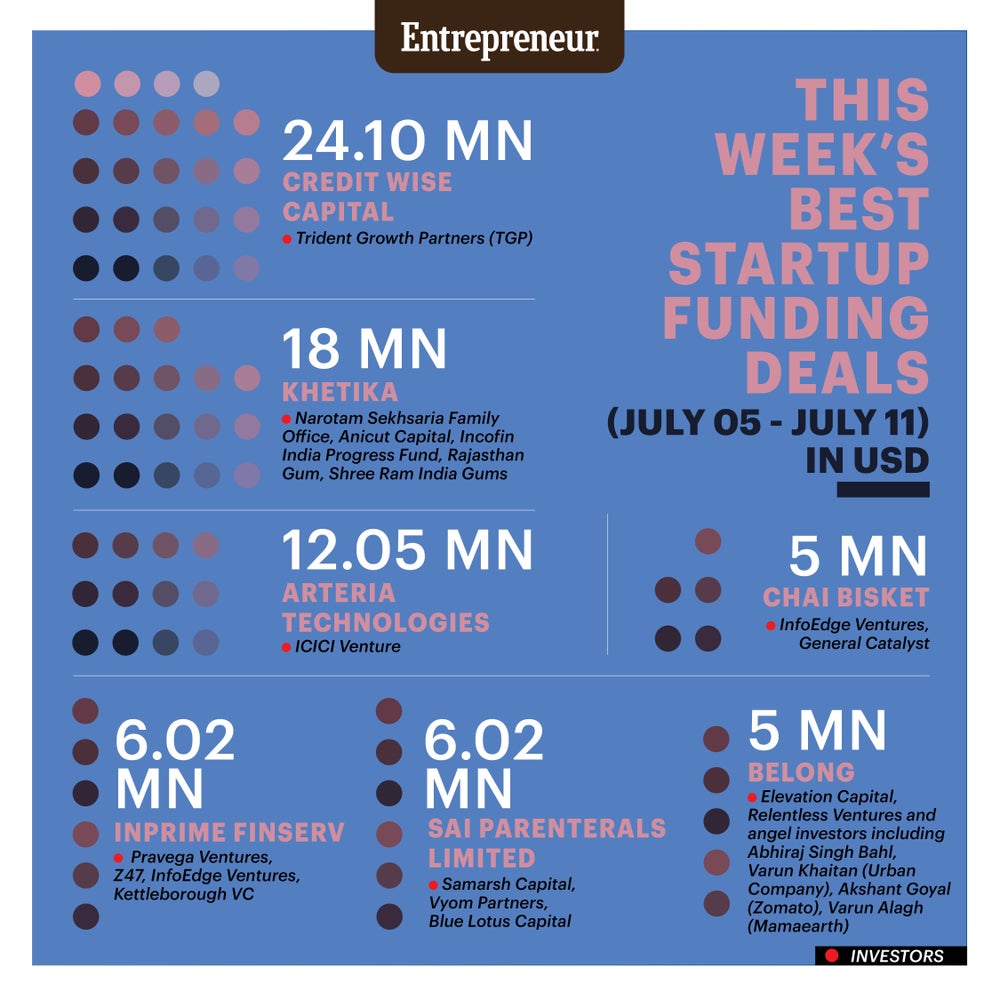

Weekly Recap: Top 7 Funding Deals of the Week (July 5–11) Diverse Sectors See Fresh Capital Inflows

Opinions expressed by BIZ Experiences contributors are their own.

You're reading BIZ Experiences India, an international franchise of BIZ Experiences Media.

The Indian startup ecosystem continues to thrive, attracting investor attention from all corners, whether it's fintech, food-tech, pharmaceuticals, or digital media. From the bustling streets of Mumbai to the innovative hub of GIFT City, we witnessed a wave of exciting funding deals this week designed to spark innovation, broaden reach, and ramp up operations. Let's take a look at seven standout funding deals that showcase the vibrant and dynamic nature of India's BIZ Experiencesial landscape.

Credit Wise Capital

Inception: 2018

Founders: Aalesh Avlani and Gurpreet Singh Sodhi

Based-out: Mumbai

Credit Wise Capital offers a range of financial services, including two-wheeler loans, personal loans, and various insurance products like health and life insurance. It also provides digital lending services, including tech-driven underwriting and collections, as well as bike servicing and roadside assistance.

Funding Amount: USD 24.10 Million

Investor: Trident Growth Partners (TGP)

Khetika

Inception: 2017

Founders: Dr Prithwi Singh, Darshan Krishnamurthy, and Raghuveer Allada

Based-out: Mumbai

Khetika is a clean-label food brand that offers staples free from preservatives, including rice, wheat, pulses, dry fruits, and fresh batters. By sourcing directly from Indian farmers, Khetika highlights traditional methods like stone-grinding and fermentation, ensuring that products such as chutneys, spices, and millet-based foods are packed with nutrition and authenticity.

Funding Amount: USD 18 Million

Investors: Narotam Sekhsaria Family Office, Anicut Capital, Incofin India Progress Fund, Rajasthan Gum, Shree Ram India Gums

Arteria Technologies

Inception: 2007

Founders: Parag Sushilkumar Jain and Sriram Kanuri

Based-out: Bengaluru

Arteria Technologies focuses on digitising supply chains using SAP solutions. Its flagship platform, FinessArt, connects supply chain participants, providing analytics, financial visibility, and decision-making tools. It also provides expert consulting services focused on SAP, covering everything from implementation and support to NetWeaver adoption.

Funding Amount: USD 12.05 Million

Investor: ICICI Venture

InPrime Finserv

Inception: 2021

Founders: Sneh Thakur, Manish Raj, and Rajat Singh

Based-out: Bengaluru

InPrime Finserv delivers customised credit solutions to underserved Informal Prime Households, including micro-entrepreneurs and small retailers. Its tech-first model integrates flexible repayment channels and gamified financial literacy programs to promote financial inclusion and empowerment.

Funding Amount: USD 6.02 Million

Investors: Pravega Ventures, Z47, InfoEdge Ventures, Kettleborough VC

Sai Parenterals Limited

Inception: 2001

Founder: Anil Karusala

Based-out: Hyderabad

Sai Parenterals is a pharmaceutical manufacturer offering CDMO services and branded exports. It produces sterile injectables, oral solids, and topical preparations. With five facilities approved by regulatory bodies like TGA and WHO-GMP, it covers the full pharmaceutical value chain from R&D to global distribution.

Funding Amount: USD 6.02 Million

Investors: Samarsh Capital, Vyom Partners, Blue Lotus Capital

Chai Bisket

Inception: 2015

Founders: Sharath Chandra and Anurag Reddy

Based-out: Hyderabad

Chai Bisket is a digital entertainment company known for vernacular content creation, influencer marketing, and film production. Its creative platform "The Stage" nurtures talent through events and workshops, while its new microdrama app "Chai Shots" targets short-form video consumption.

Funding Amount: USD 5 Million

Investors: InfoEdge Ventures, General Catalyst

Belong

Inception: 2024

Founders: Ankur Choudhary, Ayush Singh, Sai Sankar M, and Savitri Bobde

Based-out: GIFT City

Belong is a fintech platform tailored for NRIs, offering services such as fixed deposits, wealth management, and tax filing. The startup aims to simplify cross-border financial management for global Indians with user-friendly and compliant financial solutions.

Funding Amount: USD 5 Million

Investors: Elevation Capital, Relentless Ventures, and angel investors including Abhiraj Singh Bahl, Varun Khaitan, Akshant Goyal, and Varun Alagh

This week's funding deals highlight the robustness and variety of India's startup scene, with capital flowing into finance, food, pharma, tech, and media—signaling investor confidence across the board.