Indian EV Market Likely to Record 138,000 Unit Sales in 2025: Report The worldwide passenger EV market is projected to hit 20 million units in 2025, accounting for more than 20 per cent of all light-duty vehicle sales

You're reading BIZ Experiences India, an international franchise of BIZ Experiences Media.

India's electric vehicle (EV) market is surging, projected to grow nearly 40 per cent in 2025 to an estimated 138,606 units—almost all of which will be battery electric vehicles (BEVs), according to a recent report by Frost & Sullivan, presented at the BIZ Experiences India EV Show. But the road ahead is not without potholes: infrastructure gaps, foreign dependency in key components, and rising global competition all cast shadows over the country's EV ambitions.

By the end of 2025, India is expected to reach a cumulative EV penetration of around 138,000 units sold from January to December. SUVs and subcompact SUVs are currently the primary growth drivers. Despite this momentum, fuel cell electric vehicles (FCEVs) remain absent, and plug-in hybrids (PHEVs) are virtually non-existent in the market. "The Indian market is likely to record ~138,000 in unit sales in (Jan-Dec) 2025 with almost all of it being BEVs," the report states.

That number might seem modest in comparison to global trends. The worldwide passenger EV market is projected to hit 20 million units in 2025, accounting for more than 20 per cent of all light-duty vehicle sales. While India is growing, its scale remains limited in the global context.

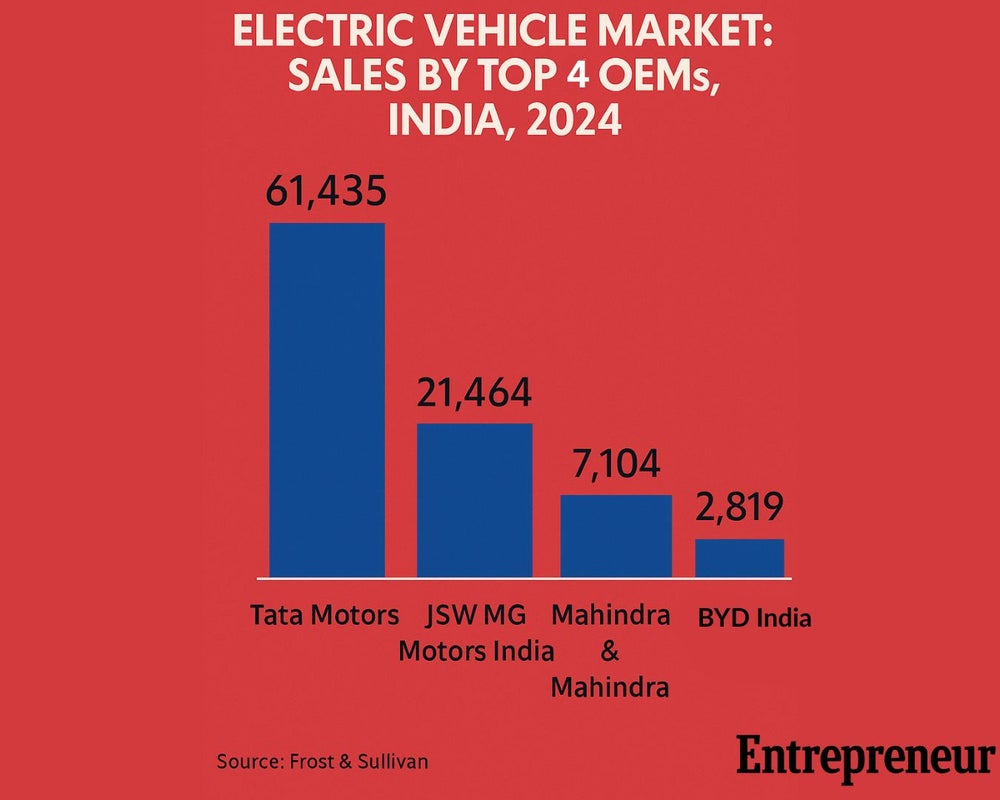

Domestic automakers are bracing for stiff competition. Tata Motors, Mahindra & Mahindra (M&M), and MG are expected to dominate India's EV sales by 2030, but each is pursuing different strategies to hold its ground. Tata is betting big on a portfolio of 10 EVs over the next decade. Mahindra aims to launch seven new battery-powered models by 2030, and MG plans to introduce mild-hybrids by 2027. All are attempting to balance innovation with affordability, amid price pressures from global OEMs, particularly those based in China.

As India tries to establish itself as a global manufacturing hub, localization has become the name of the game. Government schemes like FAME I and II, Production-Linked Incentive (PLI), and PM eBus Sewa have shifted focus from merely incentivizing purchases to nurturing a domestic supply chain. Yet, crucial gaps remain. "Battery management systems and power electronics still under development and heavy reliance on Chinese, Japanese and Korean companies," the report points out. Raw materials like lithium and cobalt remain imported, with India yet to develop large-scale cell manufacturing capabilities.

Meanwhile, EV infrastructure is struggling to keep pace. India currently operates over 25,500 public charging stations with around 60,000 connectors; roughly one for every seven EVs on the road. The ideal target by 2030 is a ratio of one connector for every five vehicles, a goal that remains distant without aggressive expansion by charge point operators and government-backed infrastructure investments.

Interoperability of charging networks and adoption of ultra-fast charging are gaining traction, but large-scale rollouts are still in early stages. The report also points to futuristic trends such as inductive charging, vehicle-to-grid tech, and 800V powertrains, but these innovations remain aspirational in the Indian context.

New business models like battery swapping and connected fleet logistics are starting to surface, especially in intra-city mobility and last-mile delivery. However, the report warns that "traditional players may lose to highly tech-driven models" if they fail to scale rapidly and adopt advanced solutions such as AI-enabled smart assembly lines, digital twins, and advanced robotics.

As for charging infrastructure, urban centers like Karnataka, Maharashtra, Delhi, and Tamil Nadu lead the deployment. Yet, states such as Bihar, Chhattisgarh, and many in the Northeast lag considerably. The disparity could hinder mass adoption outside metropolitan zones.

Incentives alone won't ensure long-term success. The report emphasizes that "OEMs will have to adjust their strategies to ongoing trends based on market conditions and application." That means flexibility in product offerings, whether it's integrating ethanol-battery hybrids or deploying eREVs (range-extended electric vehicles), will become essential.