The Founder Changing Renting Forever: The Rise of Piñata With Piñata, Liu isn't just building a company; rather, she is building a movement designed to fundamentally change what it means to be a renter, with a mission to harmonize the relationship between landlord and tenant by using common sense and smart technology to create a win-win dynamic.

Opinions expressed by BIZ Experiences contributors are their own.

You're reading BIZ Experiences Asia Pacific, an international franchise of BIZ Experiences Media.

Lily Liu, a Taiwanese-American serial BIZ Experiences, has been an innovator in govtech and financial empowerment throughout her entire career. Liu's current venture as the co-founder and CEO of Piñata, the nation's premier rewards and credit-building program for renters, is just the latest in a string of ambitious pursuits that define her career trajectory to date. With Piñata, Liu isn't just building a company; rather, she is building a movement designed to fundamentally change what it means to be a renter, with a mission to harmonize the relationship between landlord and tenant by using common sense and smart technology to create a win-win dynamic.

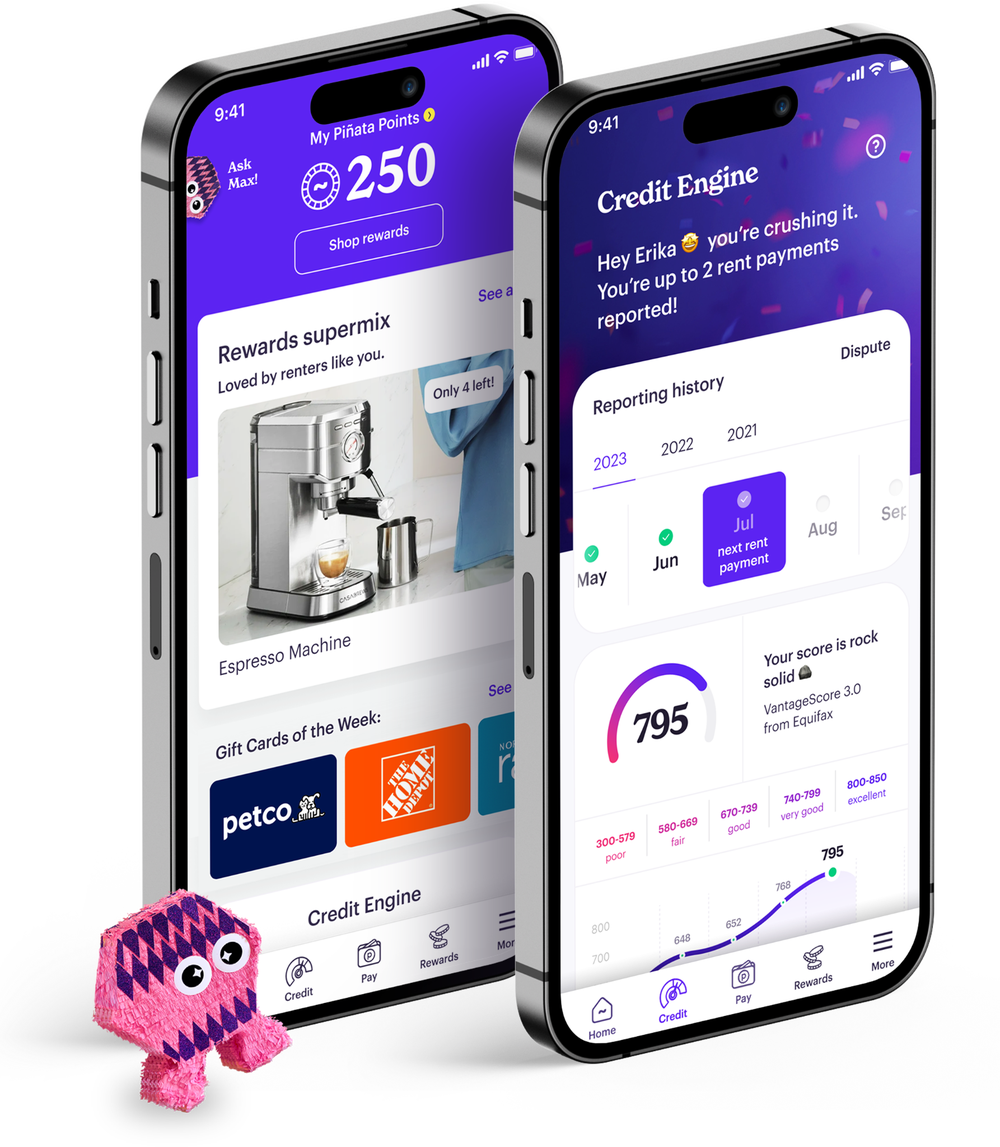

Piñata's premise is deceptively simple: leverage cutting-edge fintech, exclusive partnerships with the 3 major credit bureaus, and the power of targeted rewards to incentivize actions by doing things like early lease renewal that turn ordinary tenants into super renters. In other words, using behavior psychology to create win-wins that move the needle for both renters and landlords, alike. With millions of renters and thousands of property management companies already on the platform, the 'Powered by Piñata Network' is just getting started.

Piñata has grown exponentially from recent partnerships with best-in-class management systems like MRI Software and AppFolio, giving them a clear line of sight to over 10 million rental units, reaching 15 million renters, the equivalent of roughly 35% of the U.S. rental market. With this far-reaching approach, Piñata is proving that rent can be more than a sunk cost; it can be the starting point for credit, wealth, and dignity for renters all over the country.

Liu's BIZ Experiencesial journey is deeply rooted in her personal story. Growing up in a tightly knit family of Taiwanese immigrants, working hard and understanding the value of BIZ Experiencesial moxy has defined Lily's work philosophy ever since. This ethos of grit and savvy combined with a deep sense of mission, has allowed Lily to thrive where others have not. This includes her time at Carnegie Mellon University, where she pursued a Bachelor's and Master's degree in Public Policy and Management from the H. John Heinz III School, where she still found time to set up a free tutoring program for low-income middle school students in Pittsburgh. And if that's not enough, Lily even conducted a public surveillance art project that captured the balance between safety and privacy in urban living.

Following her graduation from Carnegie Mellon, Liu was just one of three applicants selected from hundreds to join the City of Long Beach Management Rotational Program, where she acquired skills in public works as well as large-scale IT infrastructure programs. Shortly thereafter, her acumen and analytical rigor took her to New York City, where she became the youngest analyst at the Department of Education under Mayor Bloomberg's administration. While she was there, Lily assisted in managing a $20 billion budget that involved sophisticated financial planning, navigating a complex bureaucracy, and even negotiating contracts with the teachers' unions. Her time at the Bloomberg administration not only taught her how to build and manage complex civic systems, but it also exposed her to the profound inefficiencies and structural inadequacies of government at scale.

This inherent problem ultimately led to Liu's very first venture, a govtech startup she called PublicStuff, which essentially provided a streamlined mobile-first platform that allowed citizens to report and track service requests such as filling a pothole to garbage collection. Her timing was impeccable and Public Stuff quickly spread across more than 250 municipalities throughout the United States. In 2013, Liu was named one of Forbes' 30 under 30 BIZ Experiencess and in 2015 Forbes ranked PublicStuff 85 on the list of America's most promising companies. After enjoying explosive growth, Public Stuff was acquired by Accela, the premier government in the cloud company, which was then later acquired by Berkshire Partners. With PublicStuff an unequivocal success yet moving squarely in the rearview, Lily gave herself time to recalibrate on a worldwide surf safari with the twin goals of exploring the world and getting herself ready for her next BIZ Experiencesial venture.

In 2020, Liu's focus shifted to the U.S. rental market, an industry that historically offers almost zero financial benefit to its primary customers: renters. Unlike homeowners with mortgages, renters' payments are traditionally ignored by the credit bureaus, which essentially means that people are not getting the credit they deserve (literally). That's why Liu created Piñata with a clear mission to rethink rent with a bunch of Why's. Why shouldn't renters be rewarded? Why shouldn't they get the credit they deserve? Why shouldn't payment be effortless and help build long-term financial stability? After putting together a stellar team and vigilantly focusing on building a world-class product, Piñata is now poised to transform what it means to be a renter.

The outcomes speak for themselves. Piñata users, on average, see an increase in their credit score by 60 points, with some users experiencing increases of over 100. These improvements mean access to better interest rates, credit card eligibility, auto loans, and even mortgages for many users.

One of Piñata's greatest strengths is its dual impact; delivering tangible benefits to renters while also helping landlords boost tenant satisfaction, improve on-time payments, and increase retention rates. This win-win model fueled Piñata's rapid growth, all while staying true to its mission of expanding accessibility.

Piñata offers a fully free version, while its premium service is only $5 per month, cheaper than your daily cup of coffee. Premium members unlock features such as retroactive rent reporting for 24 months, customized financial content, special giveaways, and faster reward earning.

Piñata App

Piñata App

Liu stresses that at the heart of Piñata's mission, affordability is key: "This isn't a product for the financial elite. This is a product for the people who've been left out of financial systems for too long. That's who we're building for."

State governments are also starting to appreciate the value of Piñata's mission. California's Assembly Bill 2747 recently went into effect this year, requiring landlords with 15 or more rental units to give their tenants the option to report rent payments to credit agencies. This legislation, designed to enhance renters' access to credit, is a paradigm shift in housing policy that is quickly being adopted by many other states.

Piñata provides landlords with a dynamic system that automatically reports to all three credit bureaus while complying with all legal requirements. This level of regulatory compliance is a breakthrough for all California renters and helps validate Piñata as a preeminent solution in the proptech space.

"AB 2747 is a victory for Los Angeles renters and landlords. Piñata is elated to assist in meeting this moment," said Liu. "We're not just checking compliance boxes; we're constructing strategies to increase inclusion into the financial ecosystem."

With a surge of users in California, Liu has continued to scale Piñata with other major partners, like DoorLoop and Venn. DoorLoop, a leading property management platform backed by over $100M in Series B funding, now integrates Piñata's rent reporting tools directly into its system.

Venn, another top resident experience platform, expands Piñata's impact even further. Together, these partnerships unlock powerful perks for renters, like rewards and credit-building, simply by paying rent on time. For property managers, it means higher retention, faster payments, and stronger portfolio performance.

"These partnerships are about more than convenience; they're about creating a new standard in property management," Liu noted. "We're making rent work harder for everyone involved."

Behind these partnerships and new regulations is Piñata's influence on an individual's life. Houston resident and Piñata user, Kai Osbourne, recounts his financial troubles as a lifelong renter, stating, "Since using Piñata, my credit score has jumped over 100 points. I was able to buy my first brand-new car."

Another Piñata user, Ashleigh Maya, enjoyed a lift in her car loan interest to 0% after her credit score skyrocketed from 680 to 805. These are the kind of real-life impacts Liu envisioned when creating Piñata. Among the many faces of male-dominated venture capitalism and tech startups, Liu is an oddity. As a mother and a woman of color, she showcases proven results with permanent changes through her diverse leadership and empathy.

"When someone tells you that your product helped them buy a car, or get out of debt, or rent a better home for their kids; those are the moments you realize this isn't just tech," she said. "It's life-changing," Liu said.

Piñata has a majority women-led team and prioritizes policies on fair pay and hiring without regard to gender. Liu stated, "I am creating the company that I would have liked to see while I was starting out." Liu explained, "We are not here to follow the old rules; we are here to create new ones."

Her work doesn't come from a place of disruption for disruption's sake; it comes from a place of care, equity, and service. Through Piñata, she's redefining what renting means in America and granting millions the opportunity to alter their financial narratives.

"If we can rewire the system to recognize rent as a creditworthy expense, we change lives," Liu said. "That's what drives us every day."

As the rental and financial landscapes continue to evolve, Liu's leadership struck at precisely the right moment in history. Her vision is not only timely, it's essential. She's championing a future where financial inclusion is baked into everyday systems and where renters are no longer sidelined in conversations about credit, equity, and upward mobility. In an era defined by widening wealth gaps and economic uncertainty, Liu's work offers something rare and powerful: hope, backed by real results.