Popularity of P2P Lending High in Asia than Europe, says Report Robocash Group analysed search queries related to P2P lending using statistics on Google Trends and Google AdWords

Opinions expressed by BIZ Experiences contributors are their own.

You're reading BIZ Experiences Asia Pacific, an international franchise of BIZ Experiences Media.

Gone are those days when an individual couldn't obtain loans because he/she didn't have a credit history—the first screening criterion to obtain loans from banks and financial institutions. Technology has now enabled fintech companies to directly connect borrowers with lenders, providing an alternative to get loans even if burrowers don't have a credit history. One such lending within the fintech industry is peer-to-peer (P2P) lending, which enables burrowers to obtain loans directly from lenders, cutting out the middleman such as banks.

According to a fintech holding company, Robocash Group, the popularity of "P2P lending" in Asia has grown tremendously outweighing some of the major economies in Europe. In August, it announced that Asian countries have actively promoted its growth in the last five years.

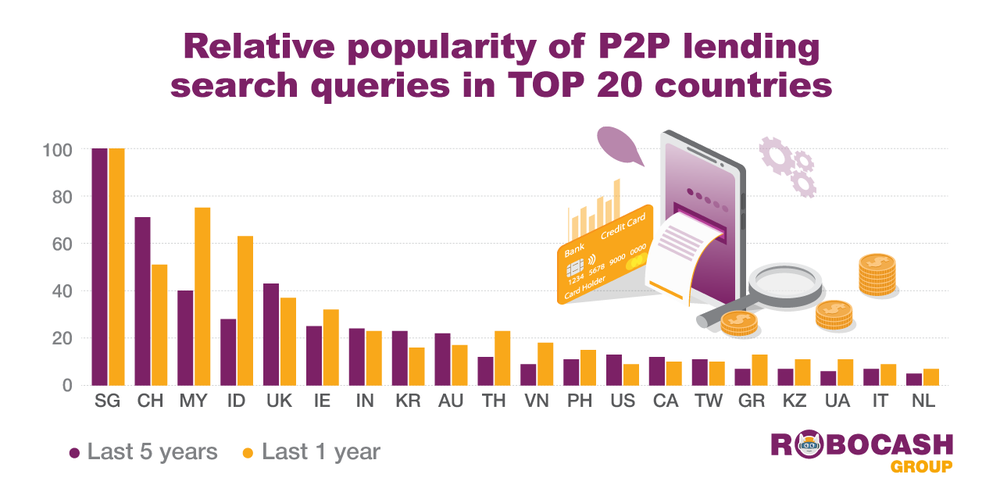

The company used the statistics on Google Trends and Google AdWords relevant for search queries—"p2p lending", "peer-to-peer lending", "peer to peer lending", "peer to peer loans", "p2p loans", "p2p investing" as well as related requests on relevant topics. On Google Trends, requests are assigned scores from 0 to 100. The more points, the higher is the share of relevant queries in comparison to all queries.

"The comparison of the frequency of queries related to P2P lending in the top 20 countries of the world has revealed that many Asian countries show a much higher interest in relevant services than a number of the developed countries in Europe. It is also confirmed by an outstanding growth of the Asian P2P lending sector," Robocash said in a statement.

According to Statista, global P2P lending market reached US$54 billion in 2018, up from an estimated $9 billion in 2014. Further, the Cambridge Center for Alternative Finance stated that the European market increased from $0.7 billion in 2015 to $2.4 billion in 2017. In Asia, it grew from $108 billion to $330 billion during the same period.

Robocash here maintains, "The aspiration to accelerate digitisation and provide higher financial inclusion of the population, even in the most remote areas, has considerably promoted such dynamic in Asia. "Records show that the development of solutions in fintech and alternative finance, including P2P lending services, is an essential part of this strategy," it added.

Credit: Robocash Group

Singapore Demonstrates Highest Interest in P2P Lending

Further the company says, despite a considerable prevalence of Chinese services in Asia—reportedly with 700 players out of 920 in Asia, in 2017—Singapore preserved its leadership by frequency of requests related to P2P lending.

"Over the last five years, people in Singapore have demonstrated the highest interest in P2P lending services and products. In 2017, its market reached $83.8 million, which comprised 58.4 per cent of the total volume in Southeast Asia," the company said.

Further the report adds that the significant growth of the market has allowed Malaysia and Indonesia to come to the front, and has also simultaneously outpaced the United Kingdom.