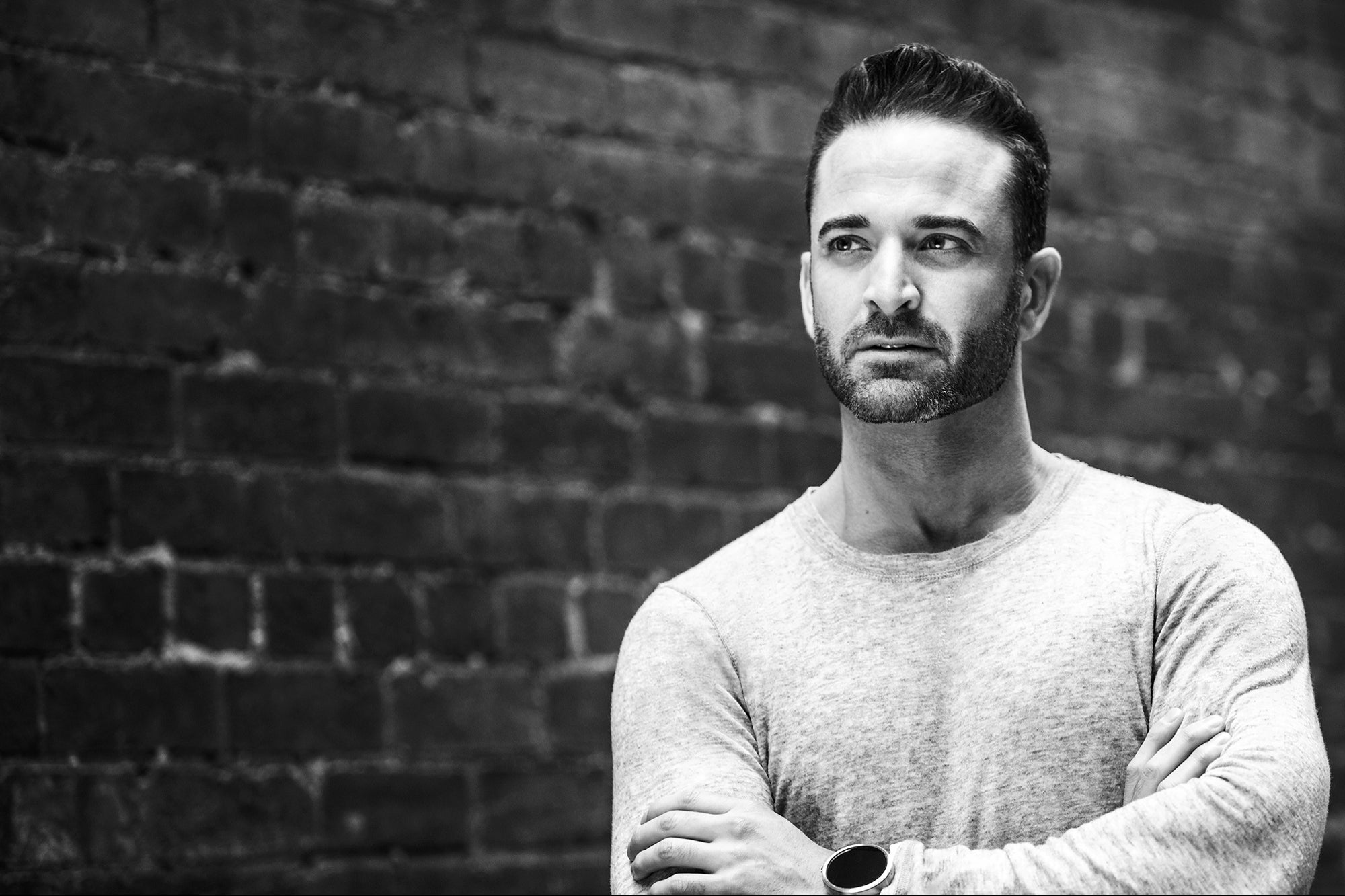

In Just 3 Words, Kevin O'Leary Offers a Grim Outlook on Interest Rates and Inflation The "Shark Tank" star appeared on Fox Business' "Sunday Night in America with Trey Gowdy" and said it is "hard to see" mortgage rates dropping any time soon.

By Emily Rella Edited by Melissa Malamut

Opinions expressed by BIZ Experiences contributors are their own.

"Shark Tank" star Kevin O'Leary has some predictions for people hoping to purchase a home in the current market — and it's not great news.

O'Leary Ventures Chairman and "Shark Tank" star Kevin O'Leary appeared on Fox Business's "Sunday Night in America with Trey Gowdy" to talk about the housing market and why prospective buyers shouldn't plan on prices cooling soon.

Related: Kevin O'Leary Issues Stark Warning About Real Estate Industry

Citing sky-high interest rates put in place to offset inflation, the investment expert noted that though "real estate has always been a good investment," it doesn't mean the prices will drop.

'Hard to see' rates dropping soon

"Only 12 months ago, we were thinking seven rate cuts, of which none have appeared because inflation remains rampant," O'Leary said, citing high interest rates. "It's hard to see that change. I'm not sure that's going to change at all.

O'Leary also mentioned the "weird outcome" of the pandemic, where people moved out of cities, which then caused those home prices to rise.

"The prices of those houses in rural regions went way through the roof," O'Leary said. "It's a new America. It's a digitized America, and housing is more expensive."

O'Leary's sentiments follow comments he made last fall on FOX Business's "Varney & Co" about the commercial real estate industry that was only getting "worse by the week."

Related: Kevin O'Leary Defends Elon Musk, Calls Out 'Loser States'

"Unfortunately, what we have is many of [commercial mortgages] are on the balance sheets of regional banks, up to 40% of their balance sheets. These are going to come through, rolling through refinancings over the next 18 to 30 months," he explained. "We're going to see more cracks on regional banks, and that's putting pressure on the loan books of those banks which are hitting small business."

The current target Fed rate is 5.25% - 5.50%. Mortgage rates for a 30-year loan are currently 6.99% per Freddie Mac.

O'Leary's estimated net worth as of Monday morning was $400 million.